Fund setup

Fund management

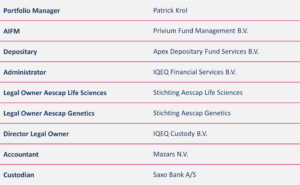

Patrick Krol is the Portfolio Manager and together with the Investment Team, he manages the investments of the Aescap funds. Privium Fund Management B.V. (Privium) is the Alternative Investment Fund Manager of the fund. The Fund Manager is responsible for the management of the fund per the provisions of the Fund Documents and applicable laws. Privium Fund Management B.V. is authorized and regulated by the Dutch Authority for the Financial Markets (www.afm.nl) as an Alternative Investment Fund Manager (AIFM) as referred to in article 2:65 (a). Both Privium and the funds are registered in the Register of AFM. Privium is a Fund Manager with offices in Amsterdam, London, Hong Kong and Singapore and focuses on alternative investments. As a group, Privium is managing over USD 3 billion. For additional information on the Fund Manager please visit Privium’s website.

Structure, service providers and governance

Both Aescap funds are funds for joint account, also known in Dutch as FGR (Fonds voor Gemene Rekening). They are tax transparent meaning they don’t pay corporate income tax. Stichting Aescap Life Sciences acts as the Legal Owner of the Aescap Life Sciences Fund. Stichting Aescap Genetics acts as the Legal Owner of the Aescap Genetics Fund. The Legal Owner’s statutory purpose is to act as Legal Owner of the investments of the Fund and to protect the interests of the investors as required by law. IQEQ Financial Services B.V has been appointed to provide certain financial, accounting, administrative and other services to the Fund. This includes the calculation of the Net Asset Value of the Fund, as well as, the participant administration. APEX Depositary Services has been appointed as Depositary and has the task to safeguard the interests of the investors of the Fund. The Depositary has delegated the safekeeping (custody) of the relevant Fund Assets to Saxo Bank.

List of involved parties

Investor Advisory Committee

Peter Jan Rubingh

Peter Jan has more than 35 years of experience in investing. He has invested in different disciplines, in almost all asset classes, and in good and bad times. From 1979 – 1993 Peter Jan worked at the Noro Group of Companies, then from 1993 – 2008 at both his own company TPR Partners and at W.P. Stewart & Co, thereafter from 2009 – 2013 at Oyens & Van Eeghen. Peter Jan has been independent as of 2014 and is mainly active as an involved and dedicated investor.

Henk Broeders

Henk brings in extensive knowledge and experience which he gained as a senior partner at McKinsey & Company in the international Financial and Insurance practice. He is currently Chairman of the Supervisory Council of UMC Utrecht, vice-chairman of the Supervisory Board and member of the Audit & Risk Committee at PGGM, member of Supervisory Council and member Remuneration Committee Stichting Leger des Heils Welzijn & Gezondheidszorg, Chairman of the Board of Stichting Hanarth Fonds (cancer research investment foundation), Chairman of the Board of Stichting Steun Amsterdam UMC Alzheimer Centrum, and member of the Advisory boards of Hersenonderzoek.nl and the Aboard consortium.

Rien de Bruine

Rien de Bruine is a director at family office Spud Capital B.V. He started his career at ING, as relationship manager Mid-Corporates, where he left after 6 years to join Van Lanschot Kempen. He worked there for 12 years, the last 7 as branch manager (Private Banking).

Rien also is on the Supervisory Board of the regional development company Impuls Zeeland N.V. and chairs the Advisory Committee of Bolster Investment Partners. Rien studied business economics at Tilburg University.

Leo Deuzeman

Leo has extensive experience in both finance and biotech. After graduating, he worked as a chartered accountant at Deloitte. He then joined Kempen & Co., where he worked for 16 years, 12 of them as CFO. He also spent 5 years as a managing partner at the private equity firm Greenfield Capital Partners.

Leo was supervisory director at Binck Bank for 11 years and held the same position at pension fund Blue Sky Group. He was also a member of the advisory board of the Biotech Turnaround Fund. Leo is currently supervisory director of Intereffekt Investment Funds, member of the Advisory Board of Monolith Fund, and Chairman of the Amstel Private Equity Club.