Aescap Life Sciences Fund

Investing in high-growth biotech companies

The Aescap Life Sciences Fund was launched on March 28, 2016. This open-end fund invests in biotech companies that develop and market next generation medical treatments.

The biotech market is a large and fast-growing market. This is driven by:

- Ageing population.

- Increased demand for ‘Western’ medicine in the emerging markets.

- Growing pressure on healthcare (costs and staff) which can be reduced by new and better medicines.

The Life Sciences Fund is managed by an experienced investment team with several team members having over 30 years experience and an excellent track record. The fund has an average annual net performance target of 20% over the mid-term (4-5 years).

An investment in the fund will not only allow for a good return on investment. It also enables the development of better treatments for diseases with a high unmet medical need such as ALS, Alzheimer’s, Arthritis, Cancer, MS, Parkinson’s and many others.

Investing in the biotech winners

There are around 1.000 public biotech companies. Each having its own risk and future earning power profile.

In our balanced portfolio we diversify over different diseases, development phases and geographies. We select companies for their growth potential (‘future earning power’), strong pipeline and limited risk (technological and financial).

In our stock picking we have a preference for companies that already have products on the market and several programs in clinical testing. We also value companies with a technology platform that can be used to develop medicines treating a variety of diseases. These companies develop their own medicines but also license products to others that are developing medicines for diseases in which the company itself has no interest in. This allows for significant royalty payments, so extra revenues.

Why Aescap?

Aescap has been investing successfully in listed biotech companies since 2016. The investment team, led by Portfolio Manager Patrick Krol, consists of very experienced professionals with different backgrounds in the healthcare industry.

Aescap’s objective is to maximize returns for our investors by selecting the biotech companies that create the medicines of the future, without taking major risks in the process. By doing this, we facilitate the development of medications for illnesses for which there currently are no effective treatments.

We are transparent, accessible and committed. Our team members invest in the Aescap funds themselves, with over € 25 million. Our Portfolio Manager as well as the Head of Investor Relations can directly be reached for any questions you may have. You can find our contact details here.

Investment strategy – focus & discipline

The Aescap Life Sciences Fund is actively managed. There is no official benchmark selected as a reference. The investment team selects companies based on ‘high conviction’. Extensive fundamental analyses combined with intense interaction with management and relevant experts like doctors, insurers and patients.

Company selection, constant monitoring of companies and an active buy and sell discipline are what drive the fund’s performance. Biotech stocks are known for their very low correlation and high volatility, caused by media, macro-events and short-term speculative investors. This creates an ideal setting for a high conviction fund manager to invest in undervalued companies with a great mid- and long-term earning power. More about our investment strategy.

ESG

Since its inception, the Aescap investment team has taken Environmental, Social and Governance (ESG) factors into consideration when analyzing the outside in and inside out facets of its portfolio companies and potential new investments. By continuously doing so, we aim to encourage companies in our sector to act with the well-being of people and our planet in mind. The Aescap Funds focus their investments in companies developing treatments that are aimed to significantly improve the life of patients and benefit society as a whole.

In March 2021 the EU introduced The Sustainable Finance Disclosure Regulation (SFDR). The SFDR aims to improve disclosure to end investors, on the sustainability impacts of investment policies and decisions by financial market participants. In doing so, a number of regimes are distinguished. The Aescap funds are so-called Article 8 funds. Here, a social characteristic is promoted. When selecting companies, particular attention is paid to those that contribute to solving a high unmet medical need. More information on sustainability/ESG.

How to invest in the Aescap Life Sciences Fund?

Would you like to benefit from the global earning power of innovative and better medicines? We’re looking forward to providing you with all necessary information. By phone, via e-mail of in person. You are very welcome to visit our office and meet the Portfolio Manager and Analysts. Please find our contact details here.

The minimum amount to invest in Aescap Life Sciences is € 500.000. For asset managers the minimum amount per deposit should be € 10.000 (this can be divided among several investors). For family and friends the Portfolio Manager may accept an amount less than € 500.000, with a minimum of € 101.000. Investors can enter and exit the fund twice per month. More information on how to make initial subscriptions.

As requested by several of our investors we created the NextGen program. This enables first- and second-degree family members of current investors to enter the Aescap funds with a minimum investment amount of € 10.000 each.

ISIN Code Aescap Life Sciences: NL0012343958

Bloomberg: AESCAPI NA Equity

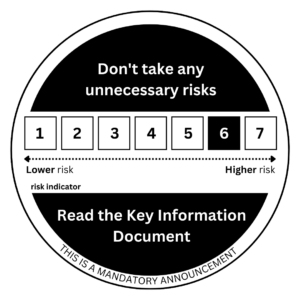

Risks

To minimise investment risks, the fund spreads its portfolio across diverse diseases, various stages of company development and different geographical areas. The fund identifies a number of risks for investors:

- Liquidity risk: a position taken by an investor may not be able to be liquidated in a timely manner at a reasonable price due to lack of liquidity (insufficient demand) in the market.

- Sector risk: the fund invests in a sector characterised by high volatility where an active investment approach is very important. This can have a positive or negative impact on the value of the fund.

- Currency risk: in principle, the fund does not hedge currency positions. Investments other than in euro may therefore cause fluctuations in the net asset value of the fund, both positive and negative.

Please check the prospectus for an overview of identified risks.